Earning your own money for the first time is priceless. After a demanding week, countless shifts and hours on the clock, it is incredibly rewarding to receive the product of hard work. Although it may be tempting to spend this money, it is necessary to save and begin responsible behaviors, early. A good practice to keep track of money and stay organized is to set aside a portion of these funds in the bank. Opening a bank account and placing roughly 10-50% of the total cash can ensure that the saver will have enough collected for the longterm.

Money should be viewed as an opportunity, an opportunity to prevent potential financial disasters or to achieve future objectives. It is much more gratifying to have a college diploma, a home, a car, or a business rather than several nonessential items. This is not to say that the occasional splurge purchase is to be discouraged. Sometimes in order to stay motivated, it is important to reward a job well done. The saver should not be deprived, but should also remember why she is trying to save in the first place. Keeping these thoughts in mind will make the sacrifice less difficult. Even if a dream or ambition seems too grand or impossible to accomplish, the saver should not be discouraged. Taking small steps by creating an easy to follow plan and money saving goals will help make steady and swift progress. As long as there is a sustainable spending balance in place, and the saver can fulfill her aspiration and the sense of pride that comes with earning it.

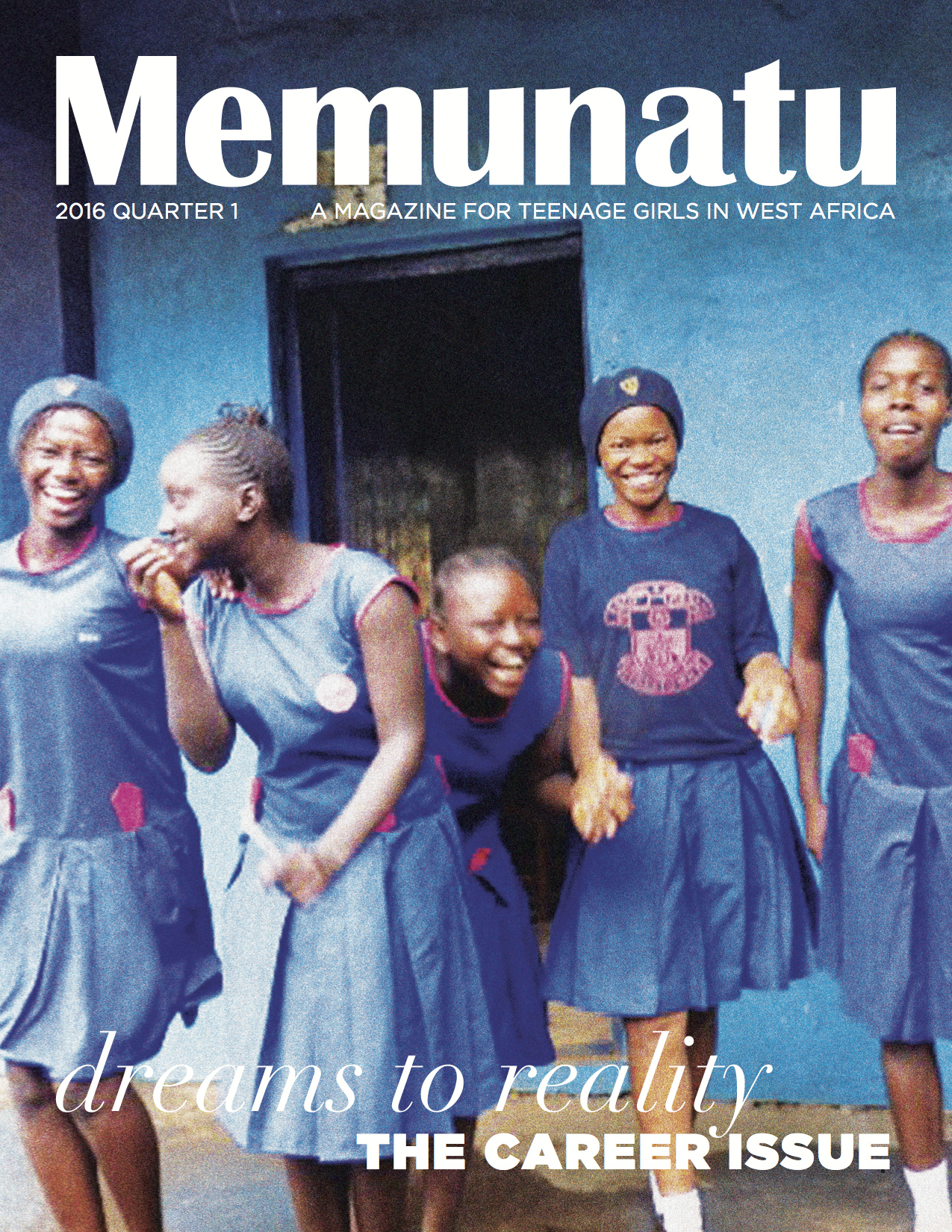

Photo Credit: Institute for Money, Technology, and Financial Inclusion

Words to Know:

Tempting = (adjective) appealing to or attracting someone, even if wrong or inadvisable

Splurge = (noun) an act of spending freely or extravagantly

Deprive = (verb) to deny the possession or use of something

– Original by Jessica G., Edited by Julia Ferragamo